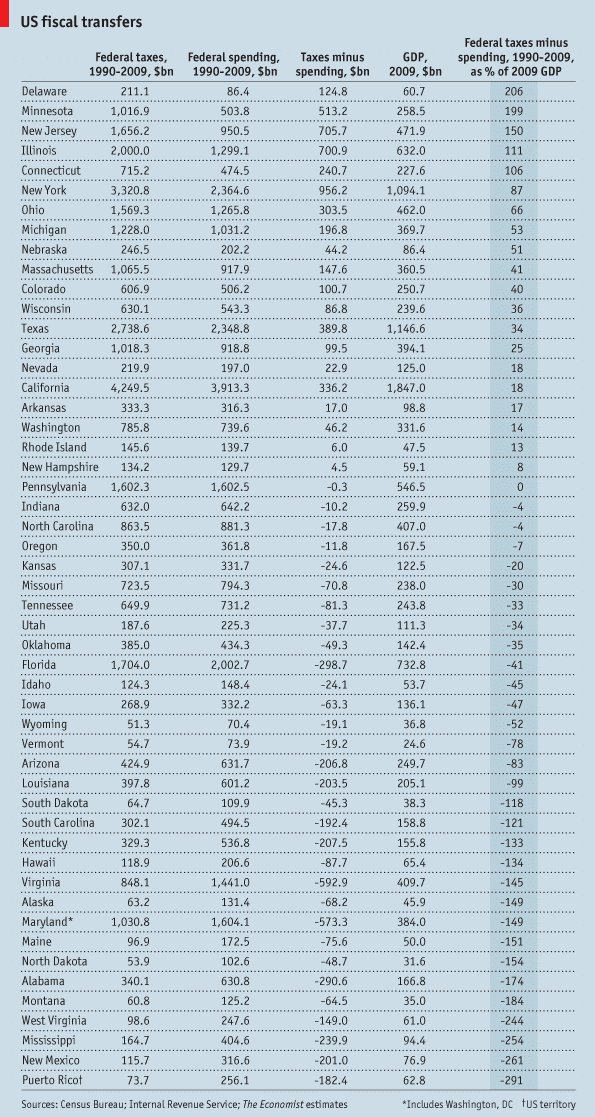

In light of recent articles arguing whether the situation in Puerto Rico differs from that of Greece, specifically by how the United States does better by having a closely knit fiscal union, this article from 2011 struck a cord with us. It analyzes federal taxes collected by every state and Puerto Rico, how much federal spending occurred in each jurisdiction, and placed it against each one’s GDP. In short, it tells us how Puerto Rico compares to the states in terms of federal spending and taxes. The result: Puerto Rico is dead last, with federal taxes minus spending as a percentage of GDP equaling -291%. That is -30% below the next jurisdiction, New Mexico.

As the Economist explains, this means richer states are transferring their wealth to the poorer ones, and then some to Puerto Rico:

Transfers to Puerto Rico, which is a US territory not a fully incorporated state, exceeded 290%. Where did these transfers come from? New York transferred over $950 billion to the rest of America’s fiscal union from 1990 to 2009. But relative to the size of its economy, Delaware made the biggest contribution, equivalent to more than twice its 2009 GDP.

So does this mean Puerto Rico is contributing nothing? Not quite. As the charts show, during the period of 1990 to 2009, Puerto Rico contributed more in federal taxes to the union, even without the federal income tax, than six other states: Montana, North Dakota, Alaska, South Dakota, Vermont and Wyoming. Now that is just in total numbers, proportionally speaking, the story would be a different one, since Puerto Rico would be 25th in terms of population if it were a state.

How Puerto Rico compares to the states in terms of federal spending and taxes

In overall terms, Puerto Rico is indeed getting the best deal out of the fiscal union, merely in terms of GDP versus federal spending. It is needless to say that this would be unsustainable, but this reality has been evident for a while now, and Washington seems content with the status quo.

That said, this information likely only fuels the perception of those who believe Puerto Rico should not receive any help during the fiscal crisis, even in the form of re-extending Chapter 9 bankruptcy protection to municipalities in the territory. In the meantime, states like New York, California and Delaware are subsidizing jurisdictions, including Puerto Rico. The one difference being, that unlike with the other jurisdictions, Congress could make the situation a bit more fair, but fully integrating the territory as a state of the union.