5 takeaways from the hearing on Puerto Rico’s debt crisis and its impact on the bond markets

On February 25, 2016, the Subcommittee on Oversight and Investigations of the United States House Financial Services Committee took on Puerto Rico’s debt crisis and its impact to investors of the island’s $3.7 trillion municipal bond market. The hearing, entitled “Puerto Rico’s Debt Crisis and its Impact on the Bond Market,” while focusing on possible solutions to the crises and its potentially devastating impact to bond investors, exposed the divergent views of House Republicans and Democrats on this issue. Here are five takeaways from the hearing.

Congress still isn’t sure what to do

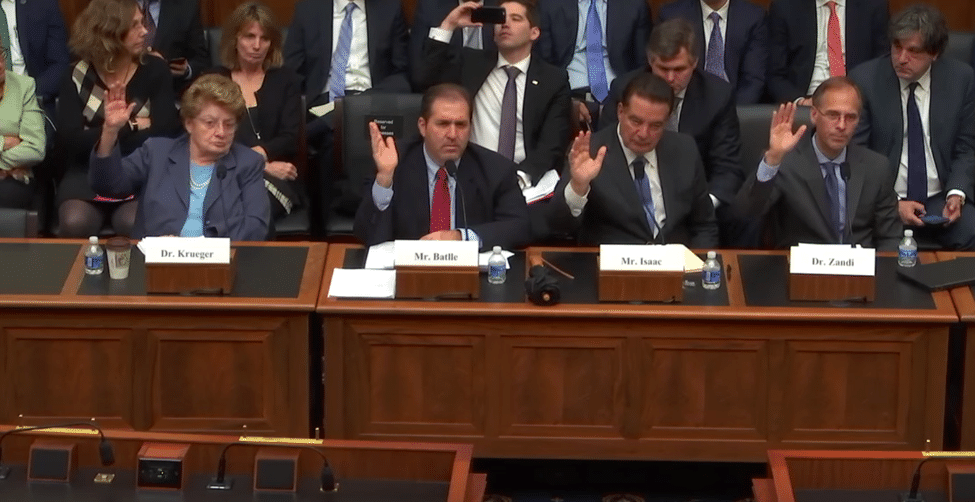

The goal of the hearing was to investigate the cause of Puerto Rico’s debt crisis, the debt crisis’ impact on Puerto Rico, solutions to the debt crisis, and the crisis’ impact on municipal bond investors. The Subcommittee had many ranking representatives present, as well as four expert witnesses. The four witnesses were Dr. Anne Krueger, Professor, Johns Hopkins University, Mr. Juan Carlos Battle, Senior Managing Director, CPG Island Servicing, LLC, The Honorable William M. Isaac, Senior Managing Director, Global Head of Financial Institutions, FTI Consulting, and Dr. Mark Zandi, Chief Economist, Moody’s Analytics.

Puerto Rico’s economy is a “mess”

To fully appreciate the debt crisis’ impact on the bond markets, it is necessary to be familiar with the current financial situation in Puerto Rico. Throughout the hearing, witnesses, as well as representatives from both sides of the aisle, presented statistics on Puerto Rico’s economic conditions. Puerto Rico currently holds debt reaching over $72 billion, which is owed to 18 different issuers. Puerto Rico has already defaulted on $174 million, with almost $2 billion due in July 2016. In addition to this significant default and the even more potentially larger default currently looming, the island has a current unemployment rate of 12% and a 40% labor participation rate. This compares poorly to the mainland’s 5% unemployment rate and 62% labor participation rate. Most significantly, the Island is the third largest issuer in the United States’ $3.7 trillion municipal bond market.

The Chapter 9 Bankruptcy question lingers

Representative Green (TX-09) began the hearing inquiring whether, “[w]ill we in the Congress allow the Americans in Puerto Rico to do the same thing we allow the Americans in the 50 states to do?” His rhetorical question implies there should be no distinction between Puerto Rican Americans and American citizens of the fifty states and the fact this has gone to a debate is akin to treating Puerto Ricans like second class citizens. The rights that representative Green speaks of are Chapter 9 Bankruptcy rights, which would allow Puerto Rico to negotiate debt directly with creditors under court supervision. Puerto Rico currently does not have this right and the discussion of the committee’ discussion surrounds Rep. Duffy’s (WI-07) bill permitting Puerto Rico to obtain Chapter 9 bankruptcy rights, a tool all states have (and that Puerto Rico had up to 1984).

Witnesses agreed bankruptcy protections must be a part of the solution for Puerto Rico

The discussion and testimony of the 4 expert witnesses focused mostly on Rep. Duffy’s House Bill 4199, which seeks to extend Chapter 9 bankruptcy protections to Puerto Rico. All four witnesses agree that bankruptcy protections must be a part of the solution for Puerto Rico.

Dr. Krueger notes the importance of establishing a legal framework with structural and fiscal reforms aimed at restructuring Puerto Rico’s debt. Krueger also discusses her worries that any extra time spent in courts would further worsen Puerto Rico’s debt crisis, driving up outmigration and lowering incomes.

Mr. Batlle, who worked under the former Puerto Rican Governor Luis Fortuno as head of the Government Development Bank for Puerto Rico, clearly supports Puerto Rico’s right to Chapter 9 bankruptcy, but stated his opposition to “Super Chapter 9 Bankruptcy,” which would allow for restructuring General Obligation debts. When discussing “Super Chapter 9” bankruptcy, he stated that “[i]ntroducing an unfamiliar mechanism would upset a very stable market and set a dangerous precedent.” Currently, no US state has the right to restructure general obligation debt.

Mr. Isaac similarly opposes “Super Chapter 9 bankruptcy” and the restructuring of General Obligation debts, noting, “if we change bankruptcy rules, it takes us down a road we don’t want to go on.”

Dr. Zandi stressed that Chapter 9 bankruptcy was only a small part of helping Puerto Rico during this financial crisis. He stressed a key to fixing Puerto Rico’s debt crisis was also through helping enable economic growth on the island.

There are major partisan differences

Republican representatives at the hearing made clear their opposition to allowing Puerto Rico acces to Chapter 9, stating they saw it as a bailout. Representative Bruce Poliquin (R-ME) criticized the Puerto Rican government, comparing it the current leadership and tax collection system to Greece and their current economic problems. He cited a poor tax collection system and “reckless behavior” of the Puerto Rican government as insufficient bases for a financial bail out. He notes, however, it is not only Puerto Rico engaging in “reckless behavior” but many other states as well. Poliquin concluded noting he wants to assist Puerto Rico but there needs to be “structural change” such as reforming tax code and collection services as well as how Puerto Rico currently operates its economy.