Puerto Rico and the state of the US bond market

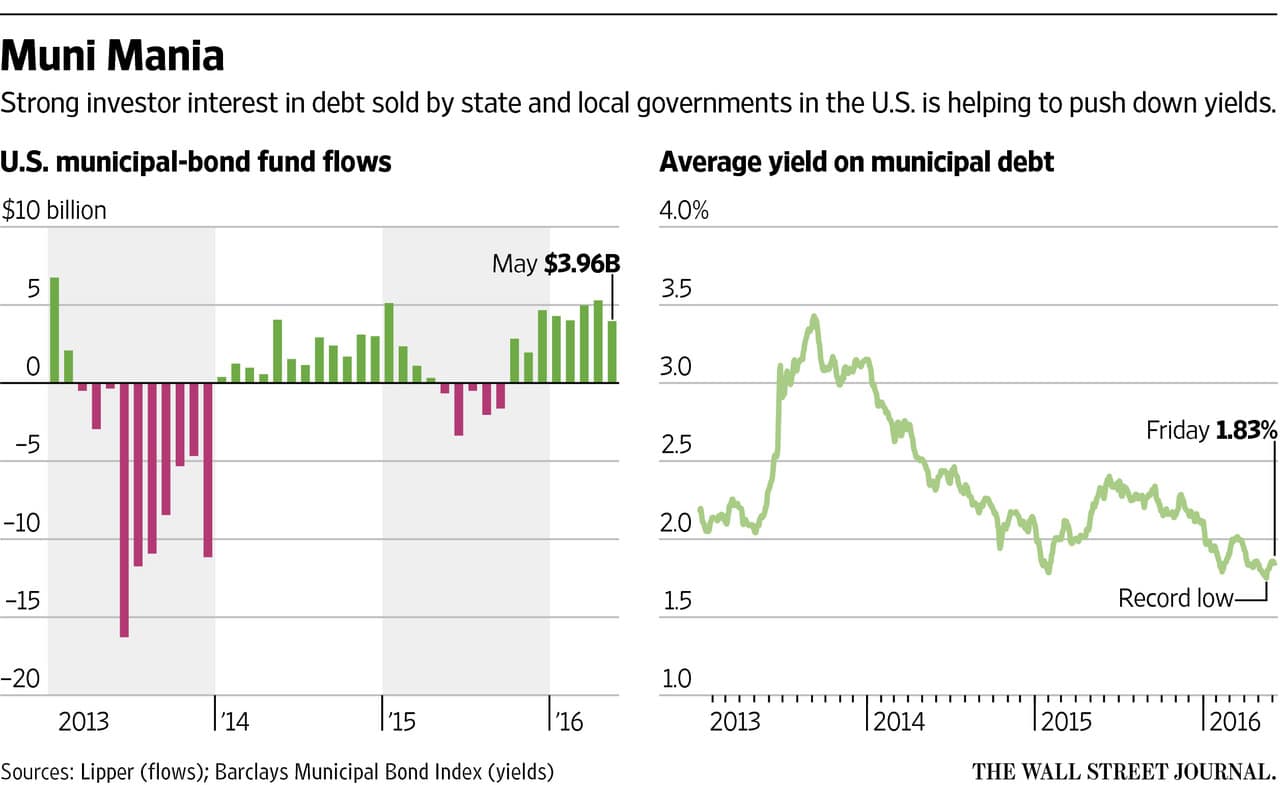

United States held municipal bonds have reached peak investment. Despite record-low yields due to consistently low interest rates, record high investment led municipal bond funds to accrue $632 billion in assets as of June 1.

This comes in direct contrast to Puerto Rican municipal bonds. Reduced to junk status in 2014 by three major credit agencies, the island’s local, state, and national tax-exempt bonds make up the vast majority of its $70 billion debt.

On May 1, Puerto Rico defaulted on the first major scheduled payment on its municipal bonds. Gov. Alejandro García Padilla warns that the country will likely default on the fast approaching July 1 payment on its general obligation bond debt. Puerto Rico must restructure its debt to meet upcoming bond payments, but pending legislation will need to pass through Congress in order to prevent the default.

Puerto Rican municipal bonds often exert an oversized influence on the entirety of the US bond market. The tax-exempt status of most Puerto Rican bonds made them an extremely popular investment during more prosperous periods in the debt-riddled island’s history. Perpetual Puerto Rican bond debt should harm the overall US bond market. Hence, the continued high quality and relative stability of US-issued municipal bonds is relatively unexpected.

Municipal Bonds vs. Treasury Bonds

May’s relatively high investment in municipal bonds comes as a reactionary measure to the Federal Reserve’s expected change in approach to monetary policy. Economists predict the Federal Reserve will tighten US monetary policy this year, reducing the attractiveness of treasury bonds and increasing the popularity of municipal bonds. Tighter monetary policy in practice equates to employing higher interest rates, discouraging borrowing and encouraging saving. More pointedly, higher interest rates cause bond prices to decrease and bond yields to increase.

Treasury bonds are generally considered risk-free; as it is highly unlikely the US Treasury would default on a bond payment. However, two current factors drastically reduce the yield potential of treasury bonds. At the moment, the US securities yield curve is the flattest it has been since 2008, indicating long term treasury bond investments yield little more profit than do short term investments. This makes present investment in treasury bonds incredibly unattractive. Additionally, the potential for an increase in interest rates means other bond types will soon represent relatively safe and increasingly higher yielding investments.

Municipal bonds function as the direct, and increasingly popular alternative to Treasury bonds. Instead of investing in national government backed bonds, investors place money in the hands of local and state authorities. These investments are backed by local or state tax revenue or fees on public services, and are often tax-exempt.

2016 has marked a shift away from Treasury bond investment and toward municipal bond investment. In a first for 2016, May saw a month over month municipal bond issuance increase. Municipal bond funds have accrued $22.5 billion from direct investment since the beginning of the year, and have pulled in $39.6 billion from equity funds over the same period. As of June 1, municipal bond funds have seen 34 straight weeks of positive inflows dating back to last October.

Record investment has produced the unintended backlash of record low yields on municipal bonds. The Federal Reserve has yet to increase interest rates, preventing the predicted increase in bond yields from taking hold. Municipal bonds have yielded only 2.89% this year, markedly lower than Treasury, corporate, or junk bonds. This hasn’t yet discouraged investors, as the municipal bond market is predicted to stay strong throughout the summer months in anticipation of the tightening of monetary policy.

Puerto Rican Municipal Bonds

The uptick in municipal bond investment is nearly inconceivable given the traditional importance of the Puerto Rican market. Prior to its recent and dramatic economic downturn, Puerto Rico used municipal bonds as the primary funding for its large civil service. Puerto Rican municipal bonds are generally tax-exempt across the US, compelling massive American investment in the Puerto Rican municipal bond market. The island constantly plugged debts by selling municipal bonds in the years leading to its economic collapse. Accrued debts soon became too massive to manage, and downturn occurred. The island territory currently has nearly the same population as Oklahoma, and yet holds a debt near equivalent to that of New York or California.

Municipal bonds led Puerto Rico into crisis, and municipal bonds form the main source of Puerto Rican debt. However, Puerto Rican economic malfeasance remains localized, holding little effect over the greater bond market. The following issues may eventually shift the overall market, but have yet to do so.

May 1 Puerto Rico Debt Default

The May 1 default caused mass hysteria. A previously indifferent Congress pushed legislation to stop further economic rot in Puerto Rico to the top of its agenda. Bloomberg and the Wall Street Journal covered every possible angle involving the default. In reality, the default was little more than a drop in the bucket. Puerto Rico defaulted on an $800 million bond payout. This foreshadows future issues, but despite the frenzy induced, the default possesses minimal power to shape the bond market.

PROMESA

As previously stated, the territory is fast approaching another debt payment cliff. To finance general obligation bond payments, the Puerto Rican government is desperately seeking passage of legislation to partially restructure their debt. The most likely solution exists in the form of the Puerto Rico Oversight, Management, and Economic Stability Act. Outside the most liberal Democrat wing of Congress, PROMESA appears to be on a steady course toward passage. The bill would allow for the restructuring of the debt created through municipal bonds backed by the same public corporations that financed its debt in the first place, including Electric Power Authority (PREPA), Aqueduct and Sewer Authority (PRASA), Highways and Transportation Authority (PRHTA), Telephone Authority, Ports Authority, and others.

The promise of potential restructuring legislation has already proved a stabilizing factor in the bond market. Highly positive inflow throughout May might indicate a response to a more active Congress. And although seemingly an avenue into further borrowing, PROMESA’s promise of oversight over new spending will quell existing fears over a Puerto Rican driven market crash.

Status of Largest Bonds

Puerto Rico has issued 12 municipal bond groups sold for over $1 billion dollars. Using Moody’s credit ratings, five hold Caa3 credit scores, four hold Ca scores, one holds a C score, and one was withdrawn. Caa3 and Ca scores represent bonds of “of poor standing and are subject to very high credit risk.” A “C” rating represents a defaulted bond. Payments on the island’s largest bond group, its $3.5 billion 2014 A General Obligation Bonds, are scheduled for July 1. Further default will likely begin to cause trouble in the overall bond market. However, the municipal bond market’s currently strong standing will likely mollify the intensity of its effects.