Predicting whether Puerto Rico will go bankrupt in 2016

With the July 1st deadline for a $2 billion dollar debt payment for Puerto Rico looming, Congress passed the debt restructuring bill, PROMESA, on June 29. The Senate swiftly passed the bill by a 68-30 vote, and it arrived at President Obama’s desk on Thursday, where he signed it into law. Senate Majority Leader Mitch McConnell said that the bill “offers Puerto Rico the best chance to return to financial stability and economic growth over the long term.” While the bill provides for an immediate structure to iron out the island’s complicated financial condition in the future, it was not able to prevent Puerto Rico from defaulting on $779 million in general obligation debt on Friday. Part of the reason for the default lies with Puerto Rico’s need to pay for its essential services in healthcare, education and emergency response systems. With only $350 million cash on hand, Puerto Rico faces a rough road ahead as it tries to pay for the services the country needs while fulfilling its debt obligations.

While Friday’s default was a significant blow to Puerto Rico’s finances, PROMESA’s passage and other potential future measures spell a better future for the island. Bankruptcy has emerged as a key element to the debate over Puerto Rico’s financial future and could function as a potential tool for Puerto Rico’s renegotiation of the terms of its debt. In 2014, Puerto Rico enacted the Recovery Act, an attempt on the island’s part to autonomously file for bankruptcy. On June 13, the Supreme Court ruled against the act, declaring the measure to be at odds with existing federal code.

At the moment, Chapter 9 of the U.S Bankruptcy Code allows municipalities within states to restructure their debt through declaring bankruptcy with the state’s permission. The current understanding of the definition of “municipalities” includes the indebted public utilities in Puerto Rico. However, because Puerto Rico is not a state, those utilities cannot use bankruptcy laws to their advantage. The island now finds itself dependent on congress to determine whether the island or its municipalities can declare bankruptcy in the future.

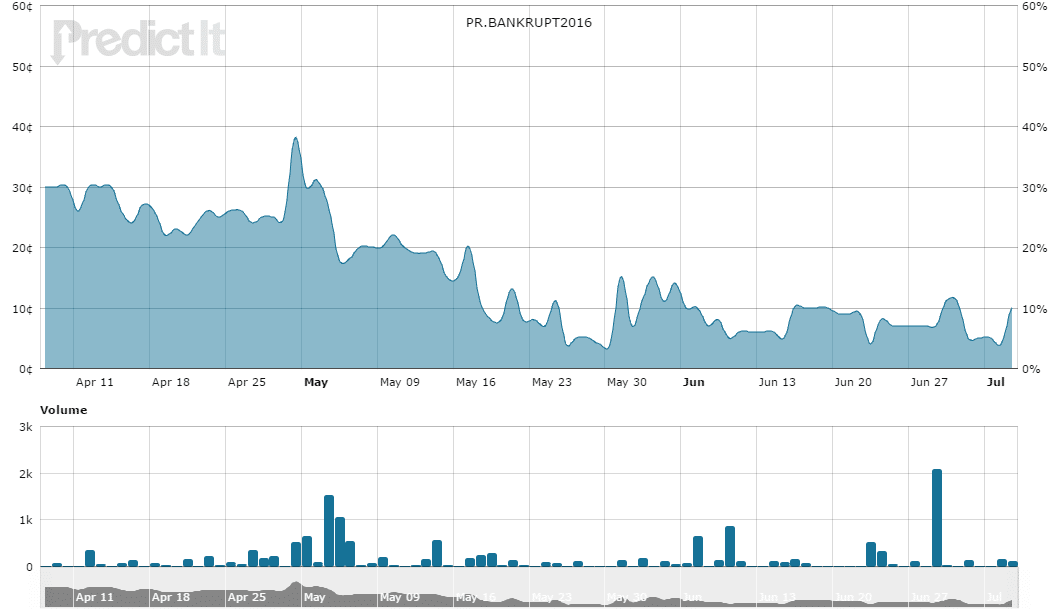

Predictit.org, a site that stages real-money political prediction market, reflects public opinion on political issues through its simulated markets. The site has created a prediction market focused on Puerto Rico’s potential bankruptcy by posing the question: Will Puerto Rico go bankrupt in 2016? The criteria for the market are that either the commonwealth as a whole or any of its municipalities will file for bankruptcy under chapter 9, Title 11 of the United States Code. Declared bankruptcy by public corporations does not fulfill the rules for the market.

Predicit.org’s chart for the stock price and volume of shares traded reveals the shifting public perceptions and confidence levels of the participants regarding the state of Puerto Rico’s affairs. A total of 20,108 shares have been traded on the market since the start date in December of last year. From the initial share price of 27 cents, the price now sits at 7 cents and has remained so since late May. In early May, when Puerto Rico defaulted on a debt payment, there was a significant selloff, resulting in the stock price dropping significantly. Upon PROMESA’s passage through the House on June 9, there was another stock price drop. The progressive decline in stock price and comparably lower volumes of stock trades in recent weeks most likely indicates a general perception that neither Puerto Rico or any of its municipalities will be able to declare bankruptcy. PROMESA’s subsequent passage in the Senate and the island’s debt default saw increased volume in shares traded but the price remains at 7 cents. The Supreme Court’s striking down attempts to self declare on Puerto Rico’s part have lessened chances of some form of bankruptcy happening. The starting offers for buying “no” shares at 96 cents with a small redeem of 1 dollar indicate that the public opinion has shifted and the likelihood is that Puerto Rico will not be declaring bankruptcy in 2016 despite its debt defaults.